bbdpl social

Joined - June 2025

Benefit

24/7 Banking & Payments

Access banking services anytime, anywhere.

Fast & Secure Transactions

Instant fund transfers, bill payments, and recharges.

Expense Tracking

Users can track spending and manage budgets easily.

Paperless Banking

Digital statements, e-KYC, and online account management.

Promotions & Rewards

Cashback, offers, and loyalty points increase engagement.

High Security

Biometric login, OTP verification, and secure encryption.

Financial Inclusion

Brings banking services to rural and underbanked regions.

Use Case

Money Transfers

Send/receive money via UPI, bank account, QR code.

Bill Payments

Pay utility bills, mobile recharge, DTH, broadband.

Account Management

Check balance, view statements, request checkbooks.

Expense Insights

Categorize and analyze spending patterns.

Loans & Credit

Apply for loans or credit cards directly in the app.

Customer Support

24/7 support for transaction or account queries.

Investments & Savings

Buy insurance, invest in mutual funds, FD/RD.

Features

User Registration & KYC

Signup/login, identity verification, secure onboarding

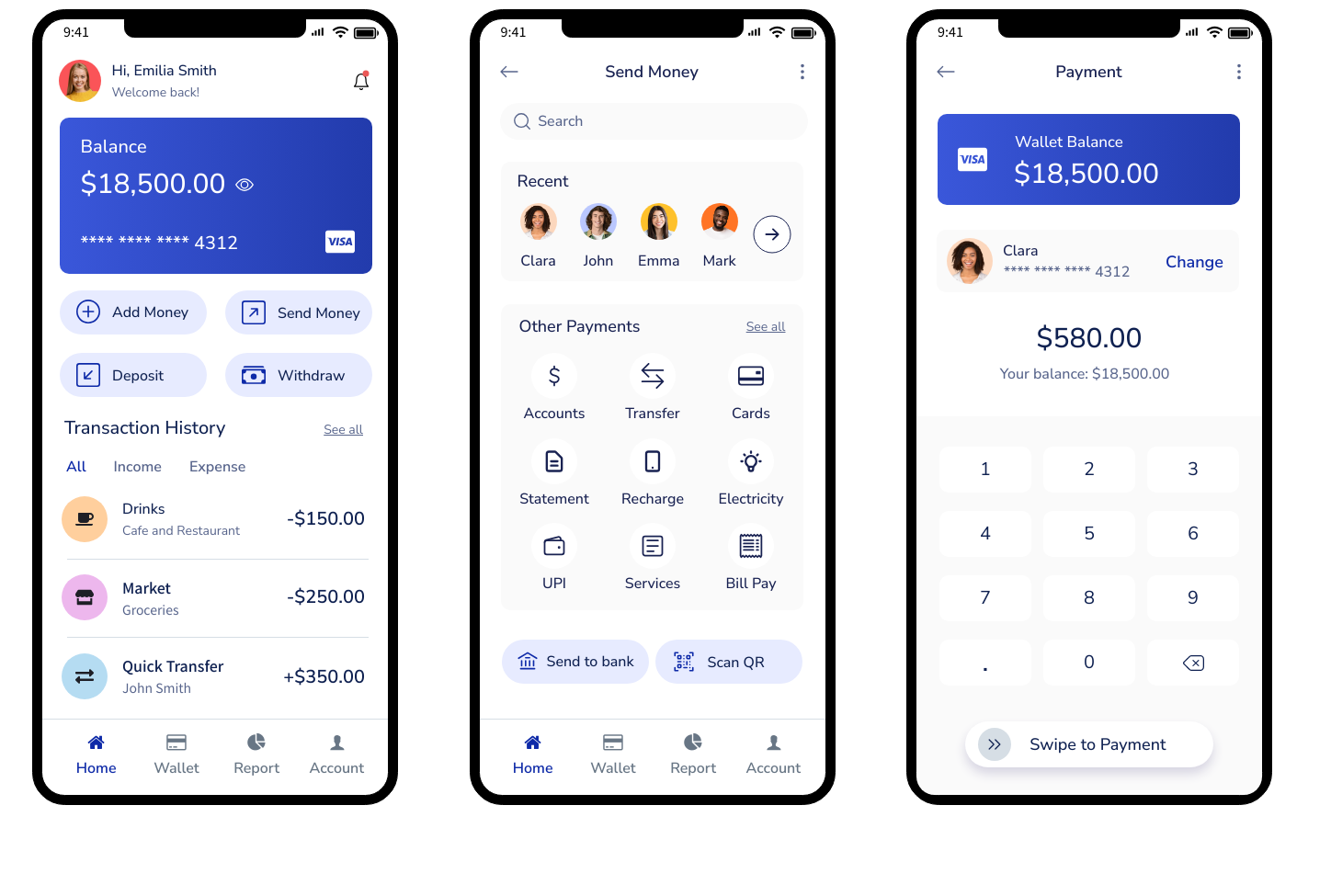

Account Dashboard

View account details, balances, recent transactions

Money Transfer (UPI, Bank Transfer)

Send/receive funds via UPI, NEFT, IMPS, QR code

Bill Payments & Recharges

Pay electricity, water, gas bills, recharge mobile/DTH

Expense Tracker & Insights

Auto-categorize expenses, generate reports

Loan & Credit Module

Apply for loans, view EMI schedule, repayment status

Investment & Savings Options

Mutual funds, insurance, fixed deposit setup

Security Features

Biometric login, OTP, encryption, fraud detection

Push Notifications & Alerts

Transaction alerts, offers, due reminders

Customer Support / Chatbot

In-app chat, FAQs, raise tickets, call support

Admin Panel (Web)

Manage users, transactions, KYC, fraud checks, reports

Get the updates, offers, tips and enhance your page building experience

Up to Top

Comments